-

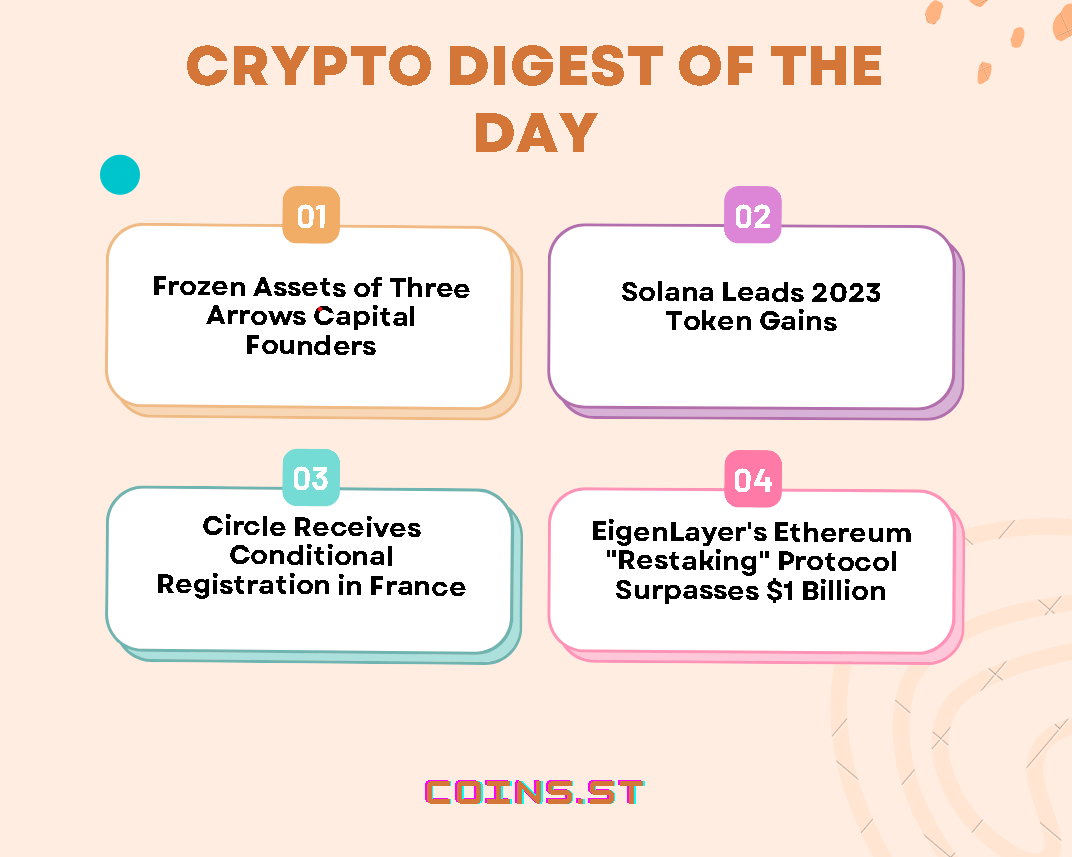

Frozen Assets of Three Arrows Capital Founders

A British Virgin Islands court has frozen over $1 billion in assets belonging to the founders of the bankrupt crypto hedge fund Three Arrows Capital (3AC). The court order, issued worldwide, applies to founders Su Zhu and Kyle Davies, along with Davies’ wife, Kelly Chen. Teneo Restructuring, the firm’s liquidators, revealed that the order is designed to prevent the founders and Chen from disposing of assets to maximize returns for creditors. 3AC filed for Chapter 15 bankruptcy in July after the collapse of stablecoin issuer Terra led to irrecoverable losses. Teneo seeks $1.3 billion and has included Chen in the order to use all available avenues for creditor returns.

-

Solana Leads 2023 Token Gains

In 2023, Layer-1 blockchain Solana (SOL) outpaced other altcoins, including Avalanche (AVAX), Stacks (STX), and Helium (HNT), in terms of token price gains. Despite regulatory challenges and its association with FTX exchange, Solana surged over 700% since the beginning of the year. Helium’s HNT gained 500%, primarily in December, driven by its move into the mobile space. Avalanche (AVAX) rose 300%, benefiting from institutional partnerships, while Stacks (STX) gained 623%, propelled by the hype around Bitcoin Ordinals and growing total value locked on the protocol.

-

Circle Receives Conditional Registration in France

Stablecoin issuer Circle has obtained conditional registration as a digital asset service provider (DASP) from France’s Financial Markets Authority (AMF). This move aligns with France’s efforts to attract crypto companies seeking regulatory clarity. Circle’s USDC stablecoin is the second-largest by market cap, and the conditional registration is a step towards operating in France. The company needs an electronic money institution license to fully operate, which it has applied for. France has been encouraging crypto companies to establish a presence within its borders, leveraging clear regulations and the European Union’s Markets in Crypto Assets (MiCA) legislation.

-

EigenLayer’s Ethereum “Restaking” Protocol Surpasses $1 Billion

Crypto deposited in Ethereum “restaking” protocol EigenLayer has exceeded $1 billion within 48 hours of reopening user deposits. EigenLayer raised the deposit cap and allowed users to deposit six additional liquid staking tokens. This rush has benefitted other liquid staking protocols like Swell and Stader, experiencing significant growth. EigenLayer’s phased rollout aims to offer “restaking,” allowing users to commit liquid staking tokens on other decentralized applications. While Ethereum co-founder Vitalik Buterin and analysts express concerns about potential network instability and liquidations, EigenLayer founder Sreeram Kannan emphasizes a cautious approach to ensure stability.